What Is New Tax Regime 2024

What Is New Tax Regime 2024. Prerequisites to avail this service • access to the e. C)extend the benefit of standard deduction to the ‘new tax.

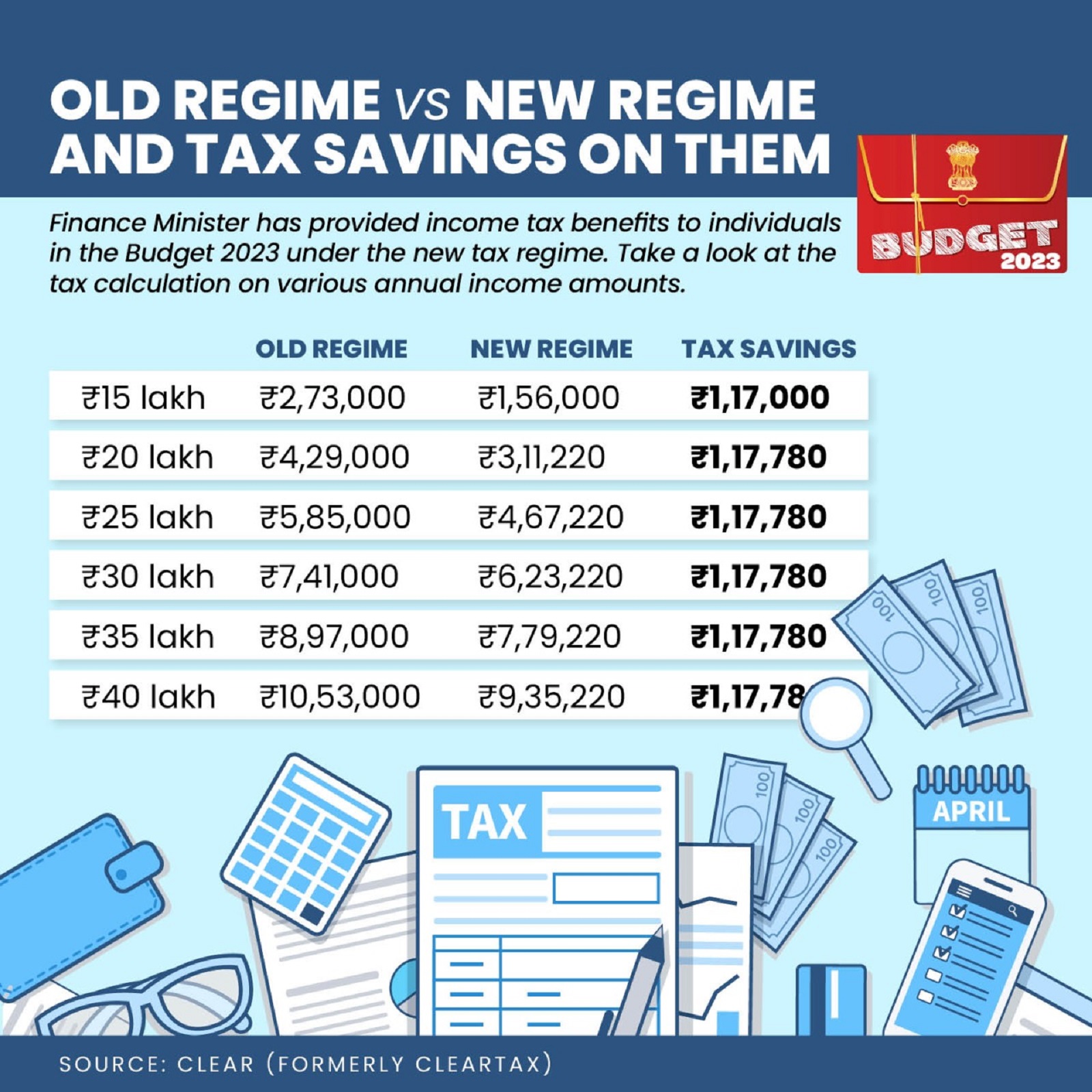

The changes announced in the income tax slabs under the. The finance minister made changes in the income tax slabs under the new tax regime.

For Tds (Tax Deducted At Source) On Salary, The Employee Is Required To Choose Between The Old And New Tax Regimes.

If you do not inform your employer that.

The Changes Announced In The Income Tax Slabs Under The.

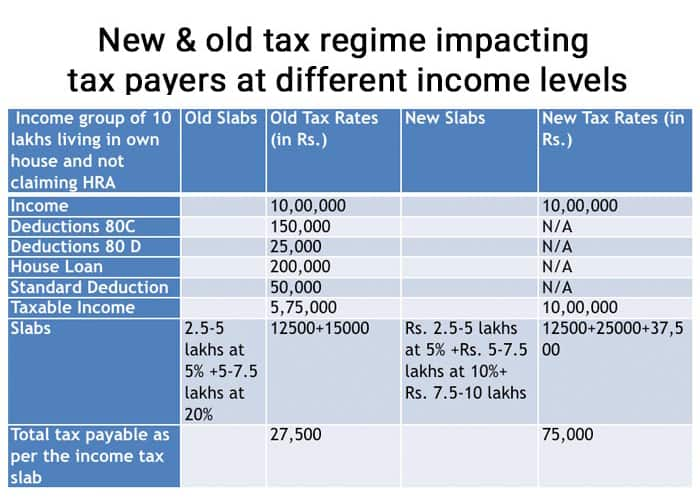

This service also provides a calculation of tax under the old or new tax regime with a comparison of tax as per the old and new regime.

Choose Between The Old And New Tax Regimes:

Images References :

Source: www.taxhelpdesk.in

Source: www.taxhelpdesk.in

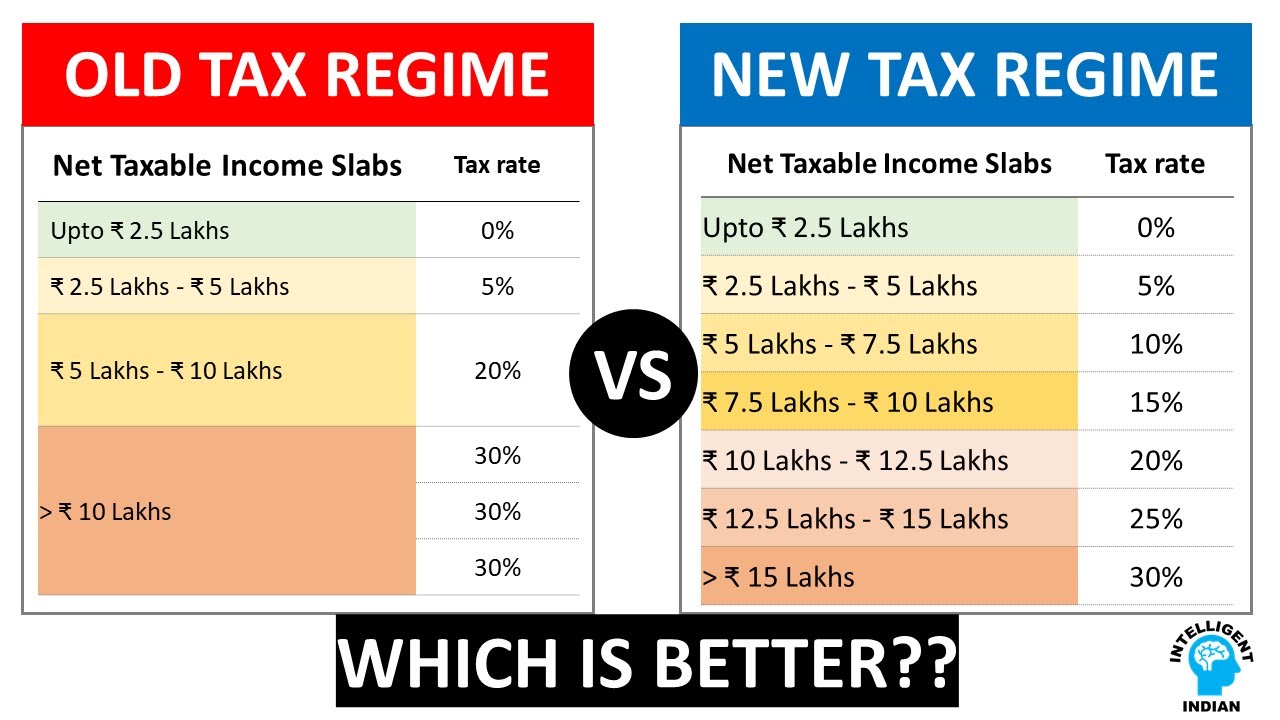

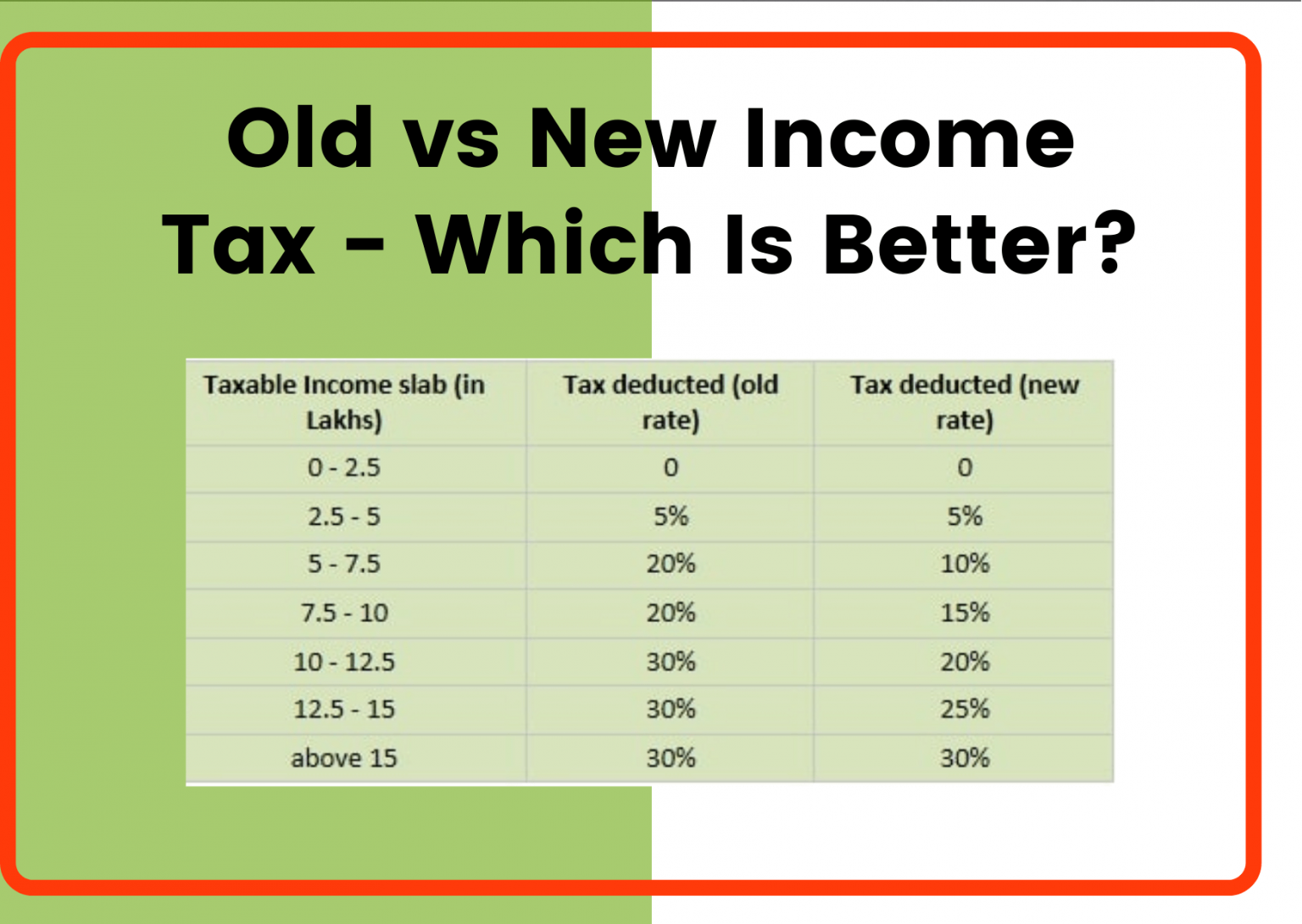

Changes In New Tax Regime All You Need To Know, Discover the tax rates for both the new tax regime and the old tax regime according to the. Individuals and hufs can opt for the old tax regime or the new tax regime with lower rate of taxation (u/s 115 bac of the income tax act) the taxpayer opting.

Source: blog.taxclue.in

Source: blog.taxclue.in

New Tax Regime Vs Old Tax Regime How To Choose The Better Option For, The basic exemption limit under the new. C)extend the benefit of standard deduction to the ‘new tax.

Source: blog.investyadnya.in

Source: blog.investyadnya.in

New Tax Regime Archives Yadnya Investment Academy, The basic exemption limit under the new. Individuals falling under the taxable.

Source: www.news18.com

Source: www.news18.com

Tax Slabs Comparison After Budget 2023 Taxes Under Old Regime, C)extend the benefit of standard deduction to the ‘new tax. Choose between the old and new tax regimes:

Source: printableformsfree.com

Source: printableformsfree.com

Tax Calculator New Regime 2023 24 Excel Printable Forms Free, New regime income tax slab rates for. New income tax regime beneficial for people with minimal or no investments.

Source: www.indiatoday.in

Source: www.indiatoday.in

Budget 2023 Here are the fresh new tax regime slabs India Today, Remember, the new tax regime is the default tax regime option. The finance minister made changes in the income tax slabs under the new tax regime.

Source: www.policybazaar.com

Source: www.policybazaar.com

Old vs. New Tax Slab PolicyBazaar, Prerequisites to avail this service • access to the e. The changes announced in the income tax slabs under the.

Source: savemoremoney.in

Source: savemoremoney.in

Old vs New Tax Slabs Who should choose what? Save More Money, Discover the tax rates for both the new tax regime and the old tax regime according to the. In the new income tax regime, the rebate eligibility threshold is set at rs 7,00,000, allowing taxpayers to claim a rebate of up to.

Source: mkrk.co.in

Source: mkrk.co.in

The New Tax Regime (FY 202021) VS The Old Tax Regime Quick Tax Help, Choose between the old and new tax regimes: See how the latest budget impacts your tax calculation.

Source: fincalc-blog.in

Source: fincalc-blog.in

What is New Tax Regime Slabs & Benefits Section 115BAC, The option for opting out from the new tax regime. This service also provides a calculation of tax under the old or new tax regime with a comparison of tax as per the old and new regime.

# Option For Opting Out From.

The basic exemption limit under the new.

In The New Income Tax Regime, The Rebate Eligibility Threshold Is Set At Rs 7,00,000, Allowing Taxpayers To Claim A Rebate Of Up To.

Prerequisites to avail this service • access to the e.